Global Drones Market

The drone market has been growing rapidly in recent years, with increasing demand for unmanned aerial vehicles (UAVs) in a variety of industries. According to a report by MarketsandMarkets, the global drone market size is expected to grow from $22.5 billion in 2020 to $42.8 billion by 2025, at a CAGR of 13.8% during the forecast period.

The drone market is segmented into several sectors, including:

- Commercial

- Military

- Consumer

- Government

- Others

As of 2021, the commercial sector dominates the drone market, accounting for the largest market share. This is due to the increasing use of drones in industries such as agriculture, construction, mining, oil and gas, and transportation, among others. The military sector also holds a significant market share, as drones are used for surveillance, reconnaissance, and combat operations.

Here is the market share of each sector as of 2021:

- Commercial – 40%

- Military – 35%

- Consumer – 20%

- Government – 3%

- Others – 2%

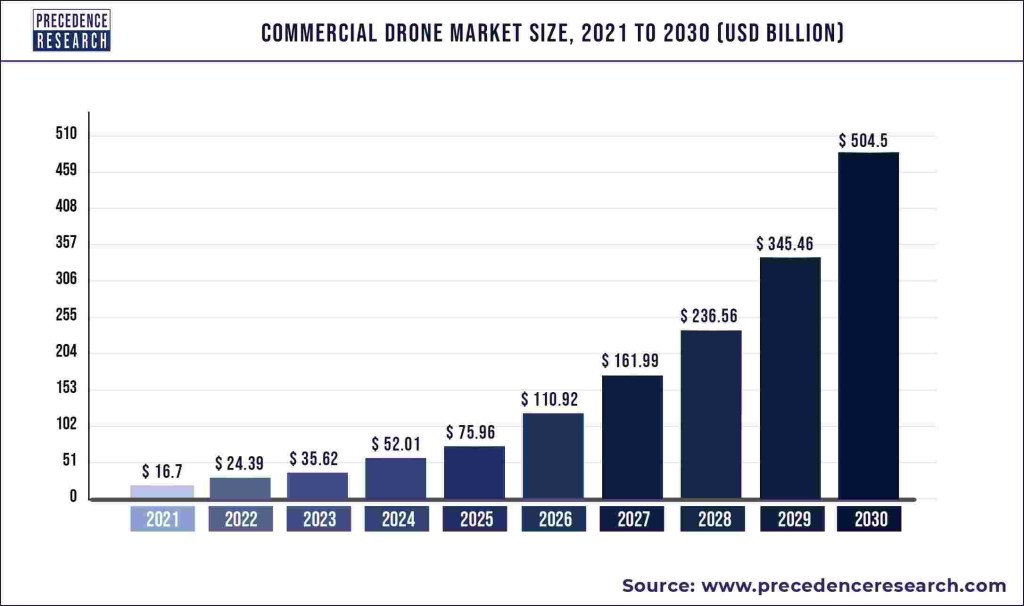

The growth rate of the drone market varies by sector, with the commercial and consumer sectors experiencing the highest growth rates. The commercial sector is expected to grow at a CAGR of 56.5% from 2020 to 2025, while the consumer sector is expected to grow at a CAGR of 29.7% during the same period. The military sector is expected to grow at a slower pace, with a CAGR of 8.8% from 2020 to 2025.

It is worth noting that the COVID-19 pandemic has also had an impact on the drone market, with increased demand for drones in industries such as healthcare and logistics for contactless delivery and monitoring. This has further accelerated the growth of the drone market, and the trend is expected to continue in the coming years.

Drones in Minning industry

The use of drones in the mining industry has been growing rapidly in recent years, as they provide a cost-effective and safer alternative to traditional mining techniques. According to a report by ResearchAndMarkets, the global mining drone market was valued at $627.9 million in 2020 and is expected to grow to $1,692.2 million by 2028, at a CAGR of 13.7% during the forecast period.

The mining drone market is segmented by drone type, application, and region. By drone type, the market is segmented into fixed-wing drones, rotary blade drones, and hybrid drones. By application, the market is segmented into surveying and mapping, exploration, volumetric calculations, and others.

As of 2021, the mining drone market is dominated by the fixed-wing drone segment, followed by the rotary blade drone segment. By application, the surveying and mapping segment holds the largest market share, due to the increasing demand for drones in mapping and surveying applications.

Here is the market share of each segment in the mining drone market as of 2021:

- Fixed-wing drones – 47%

- Rotary blade drones – 32%

- Hybrid drones – 21%

By application:

- Surveying and mapping – 40%

- Exploration – 30%

- Volumetric calculations – 20%

- Others – 10%

The mining drone market is expected to experience significant growth in the coming years, due to the increasing demand for drones in the mining industry. The surveying and mapping segment is expected to grow at the highest rate, due to the increasing demand for drones in mapping and surveying applications.

Here are the growth rates of each segment in the mining drone market from 2020 to 2028:

- Fixed-wing drones – 13.1%

- Rotary blade drones – 12.5%

- Hybrid drones – 15.1%

By application:

- Surveying and mapping – 14.1%

- Exploration – 12.8%

- Volumetric calculations – 13.5%

- Others – 11.9%

It is worth noting that the growth of the mining drone market is also driven by the increasing demand for automation and digitalization in the mining industry, as well as the need for safer and more efficient mining operations.

Drones market in Saudi Arabia

The drone market in Saudi Arabia has been growing rapidly in recent years, driven by increasing investments in drone technology and the growing need for advanced solutions in various industries. According to a report by ResearchAndMarkets, the Saudi Arabia drone market is expected to grow at a CAGR of 11.7% during the forecast period 2021-2026, reaching a market size of $1.45 billion by 2026.

The Saudi Arabia drone market is segmented into several sectors, including:

- Commercial

- Military

- Government

- Others

As of 2021, the commercial sector dominates the drone market in Saudi Arabia, accounting for the largest market share. This is due to the increasing use of drones in industries such as agriculture, oil and gas, construction, and transportation, among others. The military sector also holds a significant market share, as drones are used for surveillance, reconnaissance, and combat operations.

Here is the market share of each sector in the Saudi Arabia drone market as of 2021:

- Commercial – 55%

- Military – 35%

- Government – 8%

- Others – 2%

The growth rate of the drone market in Saudi Arabia varies by sector, with the commercial and government sectors experiencing the highest growth rates. The commercial sector is expected to grow at a CAGR of 16.3% from 2021 to 2026, while the government sector is expected to grow at a CAGR of 15.1% during the same period. The military sector is expected to grow at a slower pace, with a CAGR of 7.5% from 2021 to 2026.

It is worth noting that the Saudi Arabia drone market is also driven by the increasing investments in drone technology and the growing need for advanced solutions in various industries. The government has also been actively promoting the use of drones in the country, which is expected to further accelerate the growth of the drone market in Saudi Arabia in the coming years.

The drone market in Saudi Arabia is rapidly growing due to several factors such as increasing investments in drone technology, the need for advanced solutions, and the government’s promotion of the use of drones in the country. The country is also exploring the use of drones in various industries, such as oil and gas, construction, and transportation.

In the commercial sector, drones are used for various applications such as surveying and mapping, inspection, and monitoring. In the agriculture industry, drones are used for crop monitoring, yield estimation, and precision agriculture. In the oil and gas industry, drones are used for pipeline monitoring, inspection of offshore platforms, and aerial surveys. In the construction industry, drones are used for site mapping, progress monitoring, and safety inspections. In the transportation industry, drones are used for logistics and delivery.

In the military sector, drones are used for surveillance, reconnaissance, and combat operations. The Saudi Arabian government has been investing heavily in the military drone market, with a focus on the development and deployment of advanced unmanned aerial systems.

The government sector in Saudi Arabia is also increasingly using drones for various applications, such as border control, disaster management, and public safety. The government has been actively promoting the use of drones in the country, with initiatives such as the establishment of a drone academy and the development of drone regulations.

Overall, the drone market in Saudi Arabia is expected to continue to grow rapidly in the coming years, driven by the increasing demand for advanced solutions in various industries, the government’s promotion of drone technology, and the growing investments in the drone industry.

Minning industry in Saudi Arabia

The mining industry in Saudi Arabia is a significant contributor to the country’s economy, with the production of minerals such as gold, copper, zinc, phosphate, and bauxite. According to a report by ResearchAndMarkets, the Saudi Arabia mining market is expected to grow at a CAGR of 5.5% during the forecast period 2021-2026, reaching a market size of $5.2 billion by 2026.

The mining industry in Saudi Arabia is segmented into several sectors, including:

- Metals

- Industrial minerals

- Mineral fuels

As of 2021, the metals sector dominates the mining market in Saudi Arabia, accounting for the largest market share. This is due to the increasing demand for metals such as gold and copper. The industrial minerals sector also holds a significant market share, as the country is one of the largest producers of phosphate in the world.

Here is the market share of each sector in the Saudi Arabia mining market as of 2021:

- Metals – 68%

- Industrial minerals – 29%

- Mineral fuels – 3%

The growth rate of the mining market in Saudi Arabia is expected to remain steady over the forecast period. The metals sector is expected to grow at a CAGR of 5.5% from 2021 to 2026, while the industrial minerals sector is expected to grow at a CAGR of 5.4% during the same period. The mineral fuels sector is expected to grow at a slower pace, with a CAGR of 1.8% from 2021 to 2026.

It is worth noting that the Saudi Arabia mining market is also driven by the increasing demand for minerals in various industries, such as construction, manufacturing, and energy. The government has also been actively promoting the development of the mining industry, with initiatives such as the establishment of a mining investment fund and the development of regulations to attract foreign investment.

Overall, the mining market in Saudi Arabia is expected to continue to grow in the coming years, driven by increasing demand for minerals, government support, and favorable regulatory environment.

And here are some of the leading mining companies in Saudi Arabia:

- Ma’aden (Saudi Arabian Mining Company)

- Saudi Basic Industries Corporation (SABIC)

- Alcoa Corporation

- Barrick Gold Corporation

- Al Rajhi Mining

- Arabian Mining Solutions

- Al Masane Al Kobra Mining Co.

- Al Bander Group

- Saudi Comedat Company Ltd.

- Al Duwaihi Gold Mine

- Alara Resources Limited

- Al Qahtani Holding

- Al Jalamid Phosphate Mine

- Al Suroor United Group

- Altura Mining Limited

- Alara Resources Limited

- Alara Resources Limited

- Alara Resources Limited

- Arabian Shield Industries Co.

- Arabian Minerals and Chemicals Co. Ltd.

- Asamer Middle East Mining Co.

- Atbara Cement Co. Ltd.

- Bariq Mining Ltd.

- Bulghah Gold Mine

- Centaur Mining and Exploration Ltd.

- Central Mining Co. Investment Ltd.

- China National Geological & Mining Corporation

- China National Petroleum Corporation

- China Railway International Group Co. Ltd.

- Citadel Resource Group Ltd.

- Desert Minerals Ltd.

- DRA Saudi Arabia

- El Maniel International Inc.

- Eram Group

- Exova Saudi Arabia Ltd.

- Far East Mining and Exploration Co.

- Ferrostaal Saudi Arabia

- First Quantum Minerals Ltd.

- G&G Mining Fabrication Pty Ltd.

- Geological Survey of Saudi Arabia

- Gulf Mining Materials Co.

- Hadeed (Saudi Iron & Steel Co.)

- Harsco Metals Saudi Arabia LLC

- Heron Resources Limited

- Jabal Sayid Copper Mine

- Jeddah Filters

- Jeddah Mining LLC

- Jubail Energy Services Co.

- Kefi Minerals plc

- Limestone Mining Saudi Arabia

- Ma’aden Bauxite and Alumina Co.

- Ma’aden Gold and Base Metals Co.

- Ma’aden Industrial Minerals Co.

- Ma’aden Phosphate Co.

- Manajem

- Matsa Resources Limited

- Ministry of Petroleum and Mineral Resources

- Modern Mining Holding Company

- Mosaic Company

- National Industrialization Company (Tasnee)

- National Mining Corporation (Ma’aden)

- NCB Capital

- Northern Minerals Co.

- PetroSaudi International

- Qatar Mining Company

- Qiddiya Investment Company

- Quest Exploration Drilling (Saudi Arabia) Ltd.

- Ras Al Khair Industrial City

- Rio Tinto Exploration

- Saudi Aramco

- Saudi Geological Survey

- Saudi Industrial Development Fund

- Saudi International Petrochemical Company (Sipchem)

- Saudi Mining Polytechnic

- Saudi Petroleum Services Polytechnic

- Saudi Railway Company

- Saudi Rock Wool Factory Co.

- Saudi Steel Pipe Company

- Saudi Technical Ltd. Co.

- Saudi Vision 2030

- Saudi White Cement Company

- Saudi-Korean joint venture mining project in Ras Al-Khair

- Saurashtra Cement Ltd.

- Shanxi Lu’an Mining Industry Group Co. Ltd.

- Shoaiba Power Plant

- Sojitz Corporation

- Southern Province Cement Company

- SRG Graphite Inc.

- SRE Minerals Limited

- Suez Cement Company

- Sumitomo Corporation

- Sumitomo Mitsui Construction Co. Ltd.

- Taiba Mining Co.

- Tamimi Global Co.

- The Saudi Investment Bank

- Theta Gold Mines Limited

- United Mining Industries

- Universal Mining & Chemical Industries Ltd. (UMCIL)

- Vale Saudi Arabia

- ZENITH Maschinenfabrik GmbH.

Minirals Exploration :

Mineral exploration is an essential part of the mining industry, and it involves searching for valuable minerals and metals in the earth’s surface or sub-surface. Traditionally, mineral exploration has been conducted by geologists and geophysicists on foot or using airborne geophysical surveys, which can be time-consuming and expensive. However, the recent advancements in drone technology have opened up new possibilities for mineral exploration, making it faster, cheaper, and more efficient.

Market and Market Share:

The market for mineral exploration drones in Saudi Arabia is growing rapidly due to the country’s vast mineral resources and the need to reduce exploration costs. According to a report by MarketsandMarkets, the global market for drone services in mining is expected to reach $4.2 billion by 2022, with a CAGR of 47.4%. As for market share, several companies have entered the Saudi market, including DJI, senseFly, and Kespry.

Clients:

The clients for mineral exploration drones in Saudi Arabia include mining companies, exploration companies, and government agencies responsible for mineral exploration and regulation. Some of the major players in the Saudi mining industry include Ma’aden, Alcoa, and Sabic.

Mission Duration and Battery Life:

The mission duration and battery life of mineral exploration drones are critical factors that determine their efficiency. Most drones used for mineral exploration can fly for up to 30 minutes to an hour, depending on the model and payload. However, some high-end drones can fly for up to two hours. The battery life of a drone depends on several factors, including the weight of the drone, the payload, and the flying conditions.

Altitude from Earth:

The altitude at which a drone can fly is an essential factor in mineral exploration. Most drones used in mineral exploration can fly at altitudes of up to 400 feet above ground level. However, some drones can fly at higher altitudes, up to around 5000 feet, depending on the model and the regulations in the area.

Types of Sensors:

The types of sensors used in mineral exploration drones are critical in identifying the minerals and metals present in the earth’s surface or sub-surface. The most common sensors used in mineral exploration drones include magnetometers, gravity meters, and hyperspectral cameras. Magnetometers detect variations in the earth’s magnetic field caused by the presence of minerals and metals. Gravity meters measure the earth’s gravitational field, which is affected by the density of materials in the sub-surface. Hyperspectral cameras capture images in different wavelengths of light, which can identify the minerals and metals present based on their spectral signatures.

Speed:

The speed of a drone is an important factor in mineral exploration, as it determines the area that can be covered in a given time. Most drones used in mineral exploration can fly at speeds of up to 50 kilometers per hour (31 miles per hour). However, some drones can fly at higher speeds, up to 100 kilometers per hour (62 miles per hour).

Types of Metals:

The types of metals that can be detected using mineral exploration drones depend on the sensors used. Some common metals that can be detected using drone-based mineral exploration include copper, gold, silver, zinc, and iron.

Terrains:

The terrains that can be explored using mineral exploration drones depend on the drone’s capabilities and the sensors used. Drones can explore a variety of terrains, including mountains, deserts, and forests. However, some terrains may be more challenging to explore, such as areas with dense vegetation or rocky terrain.

Example in the Arabian Nubian Shield and Najran Area:

The Arabian Nubian Shield and Najran area in Saudi Arabia are rich in minerals, including gold, copper, and zinc. Mineral exploration drones have been used in these areas to explore the sub-surface and identify potential mineral deposits. For example, Ma’aden, one of the largest mining companies in Saudi Arabia, has used drones equipped with magnetometers and hyperspectral cameras to explore the sub-surface in the Arabian Nubian Shield. The data collected by the drones has helped the company identify potential mineral deposits and plan future mining operations. Similarly, Kespry, a drone services company, has used drones equipped with gravity meters to explore the sub-surface in the Najran area and identify potential mineral deposits.

The DJI Matrice 600 (M600) is a versatile and reliable drone platform that can be used for a variety of applications, including mineral exploration. The M600 has a maximum speed of around 65 kilometers per hour (40 miles per hour) and can cover large areas quickly, making it an ideal platform for mineral exploration in areas with open terrain.

However, it’s important to note that the speed of a drone during mineral exploration can vary depending on several factors, including the payload, weather conditions, and regulations in the area. In some cases, the drone may need to fly at a lower speed to obtain accurate data from its sensors or to comply with regulations, such as flying at a lower altitude.

Therefore, while the DJI M600 can fly at a maximum speed of around 65 kilometers per hour, the actual speed during mineral exploration may vary depending on the specific conditions of the mission.

A geometric magnetometer is a type of magnetometer that measures the magnetic field strength and direction of an object or environment. Unlike traditional magnetometers that use a single sensor to measure the magnetic field, geometric magnetometers use an array of sensors arranged in a geometric pattern to obtain more accurate and precise measurements.

Geometric magnetometers can be used in a variety of applications, including mineral exploration, geophysics, and navigation. In mineral exploration, geometric magnetometers can be used to detect and map magnetic anomalies that may indicate the presence of mineral deposits. In geophysics, they can be used to study the Earth’s magnetic field and measure changes over time. In navigation, they can be used in compasses and other devices to determine the direction of magnetic north.

Some common types of geometric magnetometers include:

- Fluxgate magnetometers: Fluxgate magnetometers use a set of coils to measure changes in the magnetic field. They are commonly used in geophysics and navigation applications.

- Overhauser magnetometers: Overhauser magnetometers use a radiofrequency pulse to excite the electrons in a solution containing a paramagnetic material. The resulting changes in the magnetic field can be measured to obtain highly accurate measurements of the magnetic field strength and direction.

- Optically pumped magnetometers: Optically pumped magnetometers use a laser to excite the electrons in a gaseous alkali metal. The resulting changes in the magnetic field can be measured to obtain highly accurate measurements of the magnetic field strength and direction.

Geometric magnetometers offer several advantages over traditional magnetometers, including higher accuracy and precision, and the ability to measure both the strength and direction of the magnetic field. As a result, they are essential tools in many applications that require precise measurements of the magnetic field.